The factoring company also takes care of chasing collection of the owed payment on behalf of the client – when the payment is made, the remaining value not initially forwarded is given to the business minus prearranged fees for their service provided. Invoice financing solutions can help to lessen the load.įinding the right invoice financing agreement can sometimes mean the difference between sinking or swimming in such a competitive sector. When working for business clients, receiving payment upon completion of the job can be hard. There are alternative funding solutions out there to help you with your publishing and/or printing business – including tailored invoice financing agreements.Īt Touch, we are experts in helping manufacturing business owners find the invoice finance they deserve. This is where invoice finance might be able to help. There are many individual reasons for cash flow problems, unique to each retailer. Invoice finance could be the key to unlock your cashflow Invoice finance can help to keep the money coming in to ensure payment delays don’t lead to drastic action.ĭemand for care homes is only growing but securing the funding to break through can be a challenge. Used by recruitment companies for decades, invoice finance is tailored perfectly to the industry. We are proud when our clients evolve into traditional funding relationships with banks.Find out how invoice financing can assist a construction company’s cash flow. We have built our business on building relationships fueled by trust, understanding, and capability. Many are not transparent, having hidden triggers for higher rates, or contracts that make it hard to move away from a funding solution.

Keep in mind: Not all factoring entities are the same.No long-term contracts, hidden fees or debt.

Factoring finance definition full#

Our 24-hour online reporting system gives you full access to funding status 24-7.Funding is not dependent on your balance sheet, or time-in-business.Credit coverage can be included to reduce risk, time and overhead expenses.We offer immediate financing upon approval.They’ll make sure you have a good view of available options and pick the right solution for your business. Our Liquid Capital Principals are growth strategy and funding experts.We offer a customized, flexible approach with local decision-makers ready to respond quickly with funding.In fact, we’ve deployed over $3 Billion in working capital across North America to help businesses grow. We are North America’s leading factoring specialists, with the largest network of offices across North America.At Liquid Capital, we look at where your business is going and give you the liquidity you need to get there faster, easier and with greater confidence. By comparison, factoring is all about looking through the windshield at where you’re going, and all the opportunities you have on the road ahead.

Major banks look in the rearview mirror – where you have been and what you have today.

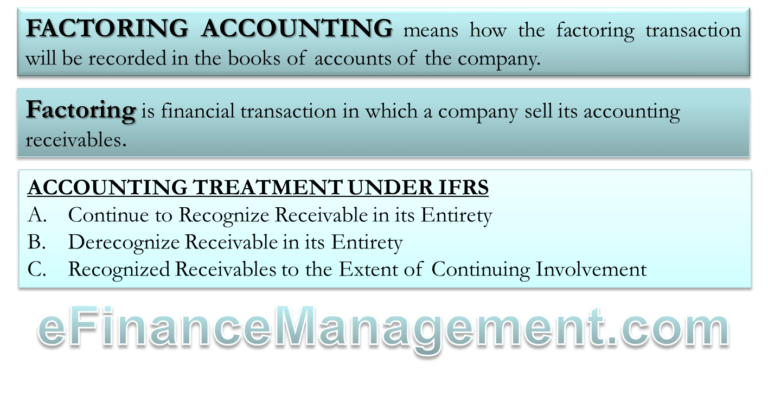

Think of your growing business like you’re driving a car. We then collect the funds from your client on your behalf and transfer the remaining balance to you, less applicable fees. Liquid Capital effectively purchases your outstanding invoices and advances you up to 85% of the value. In financial circles, there is a popular saying: “a bank only gives you money when you don’t need it.” That’s because banks operate on a line-based financing model based on what your business has already done and the assets you currently own.įactoring is an innovative way for your business to access the funds you have tied up in accounts receivable. Factoring is an alternative form of financing ideally suited to small and medium-sized businesses, especially enterprises that do not have a long and established banking record with a major lender.

0 kommentar(er)

0 kommentar(er)